Seeking $100,100 Personal bank loan? Know where you can find her or him, simply how much it prices and you can who is eligible. Getty Pictures

How would you like a lump sum matter on ballpark regarding $a hundred,100? Are you looking accomplish a primary house restoration? Therefore, an unsecured loan makes it possible to.

Very, is but one good for you? Let me reveal a closer look during the how to get a beneficial $100,100 personal loan, and additionally eligibility criteria, can cost you, and you can money go out. And, discover about three option how to get a bigger amount borrowed!

When you are in the market for an unsecured loan, contact a specialist now. They are able to respond to questions you have got which help you earn become.

What’s Unsecured loan?

A personal bank loan try a payment mortgage that individual borrowers is receive and employ for personal aim particularly debt consolidation reduction, do-it-yourself and scientific emergencies. It is usually unsecured thus acceptance requires good credit and a stable income source. Abreast of approval, borrowers receive a lump sum get better after which pay it off more than a specified amount of days (known as the tenor), including attract.

How to get an excellent $a hundred,100000 mortgage

Step one obtaining a beneficial $100,000 consumer loan try finding one. Although financial institutions, credit unions and online lenders promote signature loans, some bring financing quantity up to $one hundred,100. He told you, he’s available to you. Certain well-known businesses that already bring are usually Lightstream and you may SoFi.

How can you qualify for an unsecured loan out of $one hundred,000?

After https://paydayloancolorado.net/eads/ you have a primary a number of lenders that provide $a hundred,100 loans, the next phase is to see if your be considered. Quite often, $100,000 ‘s the premier personal loan count on offer. Thus, precisely the extremely really-licensed individuals is eligible.

- Significant credit rating of five+ ages with different particular borrowing from the bank

- Property one to prove your capability to keep

- secure income that is ample to pay off the newest loan

- Sophisticated payment history no unpleasant affairs

Qualifications will vary by financial, but most want excellent borrowing and you can a stable income source you to can certainly cover the repayments.

Do you think you may be qualified to receive so it matter financing? Keep in touch with a personal loan specialist now who’ll help you score create.

The length of time do you actually need to pay off of the $one hundred,100 loan?

Loan providers are different in the manner enough time it ensure it is individuals to spend off unsecured loans. For example, Lightstream also provides mortgage terms and conditions you to start around a couple so you can several many years, while Wells Fargo’s terms may include you to eight age. Longer terms trigger straight down payment per month amounts, nevertheless they be more expensive through the years of the more interest. You’ll need to weigh the benefits and you can cons to decide and that term is the best for your situation.

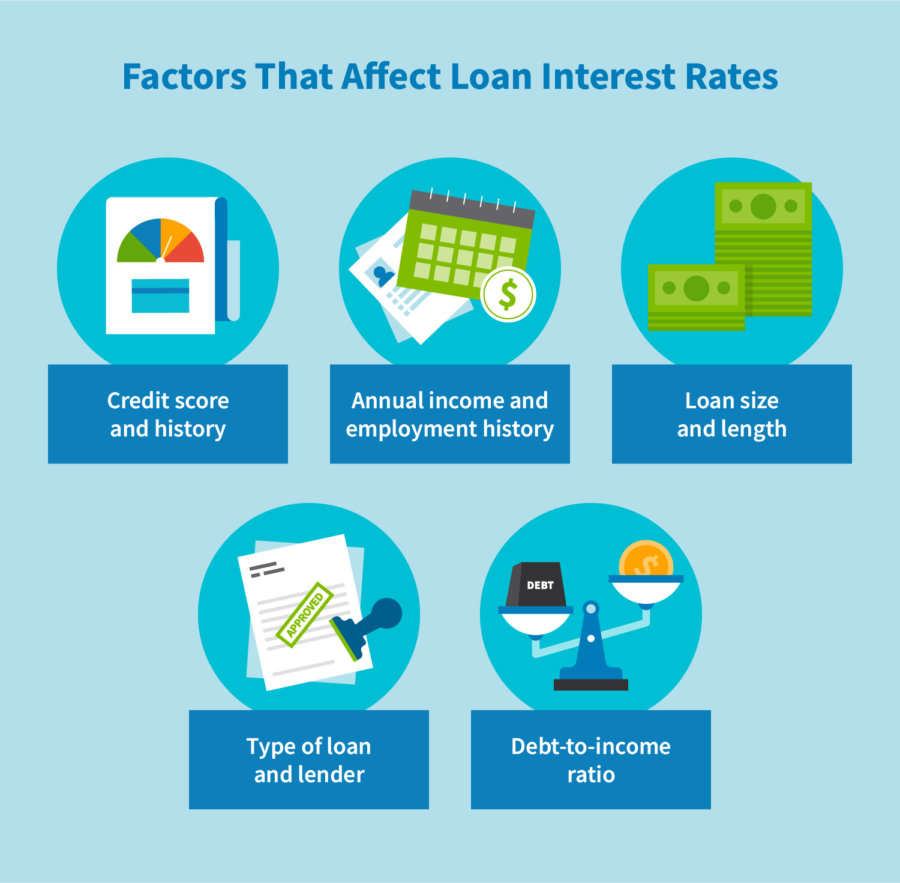

The cost of a good $100,100000 loan, and you can any mortgage for instance, relies on the fresh new cost and terminology you earn. Far more particularly, you will have to go through the fees recharged, your fixed interest, and the financing name.

After you have filled out a personal bank loan software and you may gotten an offer, explore a consumer loan calculator so you can guess the total cost.

How much time can it sample rating good $a hundred,100 loan?

Capital minutes with the good $100,000 unsecured loan depends on your own lender’s origination procedure. However, it happens quite quick. Like, Lightstream states which brings borrowing elizabeth date. To know what can be expected, see the financial support times of the lenders you are considering. More resources for Lightstream, click here.

$one hundred,100 mortgage choice

Large personal loans will be brief and you can convenient for licensed someone. However, they could also come which have rigid qualification conditions and highest APRs. Very, just what are particular alternatives?

- If you’re a resident, consider borrowing from the bank up against your house security or look into dollars-aside refinancing.

- An opposite home loan may also be a choice while you are at the very least 62 years old and you will own your home (or much of they).

- For those who have good 401(k) package, you may be able to borrow against they without having any credit checks and very aggressive rates.

Overall, you can find routes you can decide to try secure a massive loan. Be sure to weigh the options to find the best fit. And remember to get the best purchases! Costs, terminology and recognition requirements have a tendency to range from one to bank to a different. Keep in touch with a professional otherwise use the table less than to acquire already been.